Key Tax considerations in a cross-border acquisition

Mergers and acquisitions (M&A) are a permanent aspect of global markets and a highly effective way to swiftly enter the Indian market. While the characteristics and magnitude of M&A activities mirror the state of the global economy, in India, government-led regulatory and policy reforms have significantly boosted both international and domestic M&A activity.

Taxation has always been a pivotal factor in shaping M&A activities in India. With the continuous evolution of global tax laws and substantial changes in both international and Indian tax policies, administration, and adjudication, the role of tax as a strategic planning tool in M&A is anticipated to become even more prominent.

Additionally, tax disputes arising from M&A activities in India have frequently captured public attention. Notable examples include the Vodafone case and the Cairn restructuring, both of which involved indirect transfers. These cases, where tax demands were based on retrospective amendments to tax laws, serve as a reminder of the importance of being mindful of potential tax risks and the possibility of extended litigation when structuring M&A transactions.

Categories of M&A

The Indian Income Tax Act, 1961 (ITA) encompasses various provisions that address the taxation of different types of M&A transactions. In India, M&A can be structured in several ways, and the tax consequences differ depending on the chosen structure for a specific deal. M&A transactions can be carried out through:

- Share Acquisition

- Asset Acquisition

(i) Acquisition of the entire business

(ii) Acquisition of individual assets - Merger

- Demerger

In this article, we will concentrate on Share Acquisition and Asset Acquisition.

Tax considerations for the Buyer

Share Acquisition

In a share acquisition, the buyer purchases the target company’s equity from its owners/sellers, becoming the new equity owner. This method is very common in India, with transactions often involving cash payments or, more recently, stock swaps, especially when sellers wish to remain involved in the business.

- Tax Losses : The continuity of tax losses depends on whether the target company is publicly held. If a non-public company experiences a change in voting power exceeding 51% (between the end of the year and the end of the year in which a loss is incurred), any accumulated losses are forfeited and no set- off of the loss shall be allowed in the year in which the change in shareholding takes place, except in cases of amalgamation or demerger of the parent company, provided certain conditions are met. This rule applies only to business and capital losses, not unabsorbed depreciation. However in case of certain eligible start-ups, this condition may not apply if all the shareholders of the company prior to the transfer remain shareholders in the company, post the transfer.

- Cost Base Adjustment : In a share acquisition, the asset cost base for tax purposes remains unchanged. Any premium paid for the shares is not added to the asset value but is deductible for tax purposes only upon the future transfer of the shares.

- Intangible Assets: No intangible assets are recognised in the books of the target company.

- Stamp Duty : Share transfers incur a stamp duty of 0.015% of the deal value, typically paid by the buyer. This applies to both transfer of shares in physical form and of demat shares.

- GST : Not applicable on sale of shares as “securities” are specifically excluded from the definition of goods and services.

Asset Acquisition

An asset acquisition can be of the entire business or of individual assets. A business acquisition involves acquiring an entire business division, which includes all assets and liabilities that form part of its operations, typically for a single lump sum payment, such a transaction is generally classified as a ‘slump sale’ transaction. Conversely, acquiring individual assets means purchasing separate assets that may not encompass an entire business entity. Tax implications vary between these two cases.

Acquisition of the entire business

- Tax Losses : In a slump sale, tax losses remain with the seller, along with minimum alternate tax credits.

- Cost Base Adjustment : The buyer can allocate the lump sum consideration to individual assets and liabilities, allowing for depreciation based on the allocated values.

- Intangible Assets : Buyers can allocate a portion of the consideration to intangible assets acquired in the transaction.

- Stamp Duty : Stamp duty varies by Indian state, applicable to assets based on their location. Buyers typically cover stamp duty costs.

- GST : Not applicable in slump sale, in case the

business is transferred as a ‘going concern’.

Acquisition of Individual Assets

- Tax Losses : Similar to a slump sale, tax losses and minimum alternate tax credits stay with the seller in an itemized sale.

- Cost Base Adjustment : The actual consideration paid becomes the cost base for depreciation and capital gains.

- Stamp Duty : Stamp duty varies by Indian state, applicable to assets based on their location. Buyers typically cover stamp duty costs.

- GST : Applicable. Ranges from 0% to 28% depending on the nature of assets sold.

ESOPs and Employee Taxation

M&A often involve the transfer of employees, which requires careful consideration of several factors:

- Employee Transfer : Deciding whether the transfer should be part of the acquisition or handled through resignation and re-hire.

- Incentives : Determining if stock or similar incentives will continue, and how to compensate employees if not.

- Retention : Strategies to incentivize employees to stay post-acquisition.

- Withholding Tax : Understanding the tax obligations for both the transferor and transferee entities.

Each M&A transaction must be analysed on a case-by- case basis, considering the commercial, strategic, legal, regulatory, and tax implications. This section highlights key tax implications, especially regarding withholding tax obligations.

Employee Transfer and Taxation

When employees are transferred between corporate entities during M&A, tax implications and withholding tax obligations depend on how employee incentives, including Employee Stock Ownership Plans (ESOPs), are managed. If incentives are modified or terminated, the responsible entity must withhold tax on any payments made.

a. ESOPs

- Termination: If ESOPs are terminated without a cash payout, this may not be taxable as capital gains since unvested stock options only confer contingent rights.

- Cash Payout : If termination includes a cash payout, it is taxable as income for the employee and subject to withholding tax in the hands of the transferor entity.

- Grant in Transferee Entity : No tax liability at the time of grant; tax liability arises upon exercise after the vesting period, with the transferee entity responsible for withholding tax..

b. Transition Payments

If the transferee entity pays amounts due from the transferor entity without a contractual obligation, it usually does not withhold tax. However, if there is an obligation, the transferee must withhold tax at the time of payment.

M&A without Employee Transfer

In acquisitions through share transfer, the corporate entity engaging employees does not change, but control and management may. Generally, employee incentives, including ESOPs, remain unaffected unless there is a change in the parent entity of the target, making the considerations for employee transfers relevant.

Taxation of other components

- Taxation of Non-Compete Expenditure

- Taxation of Earn-out Arrangements

- Acquisition of the Goodwill: is not a depreciable asset

Managing Risk in M&A Transactions

In cross-border M&A transactions involving Indian assets, such as shares of an Indian company, key tax risks include :

- Withholding Tax : The buyer may need to withhold tax when paying a non-resident seller if the gains are taxable in India. However, as a precaution the buyer can also approach the tax authorities for lower tax deduction/ nil deduction in case favourable Tax Treaty provisions are being invoked.

- Agency Assessment : The buyer could be deemed an agent of the non-resident seller, leading to tax liability in a representative capacity..

- Void Transactions : Transfers by sellers with outstanding tax demands or pending proceedings can be void under certain circumstances..

In order to mitigate these risks, especially the risk relating to potential liability arising on account of withholding tax obligations, buyers generally insist upon indemnities, escrow arrangements or a tax insurance cover to safeguard their interests.

Alternatively, parties can seek certainty from tax authorities by :

- Obtaining a withholding tax certificate from the tax authorities

- Obtaining a ruling from Board of Advance Rulings

- Obtaining a certificate under section 162 (in respect of potential liability as a representative assessee)

- Obtaining a No Objection Certificate (NOC) under section 281.

Negotiating tax risks is crucial in M&A transactions involving Indian assets. While some uncertainty is inevitable, obtaining tax certificates and engaging with tax officials can significantly mitigate risks.

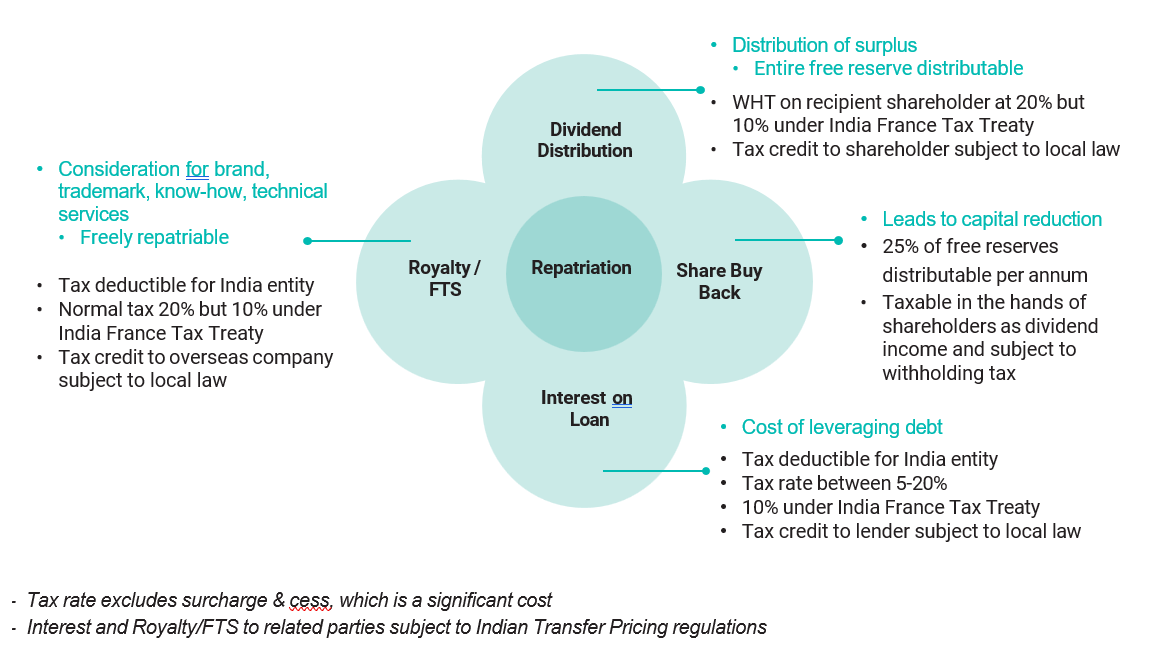

Investment Structuring & Funds Repatriation

Considering the benefits a non-resident can claim under a Double Taxation Avoidance Agreement (DTAA), certain jurisdictions offer more advantageous routes for structuring investments into India. It is essential to demonstrate commercial substance in these arrangements. Below are key methods to repatriate funds from your Indian legal entity, with the example of France :

Conclusion

Navigating tax considerations in cross-border acquisitions involving Indian assets requires a deep understanding of domestic and international tax laws. Buyers should be aware of key tax provisions related to withholding taxes, tax loss continuity, intangible assets and employee taxation. Recent amendments and court rulings must also be considered. Mitigating tax risks through indemnities, escrow arrangements, or tax insurance, and leveraging favourable DTAAs can optimize tax efficiency. In summary, a strategic approach to tax planning in M&A transactions enhances compliance and maximizes financial benefits.